new capital gains tax plan

Web The new rate would apply to gains realized after Sep. Getty Images Representative image.

Staying Ahead Of Capital Gains Tax Changes Bdo Insights

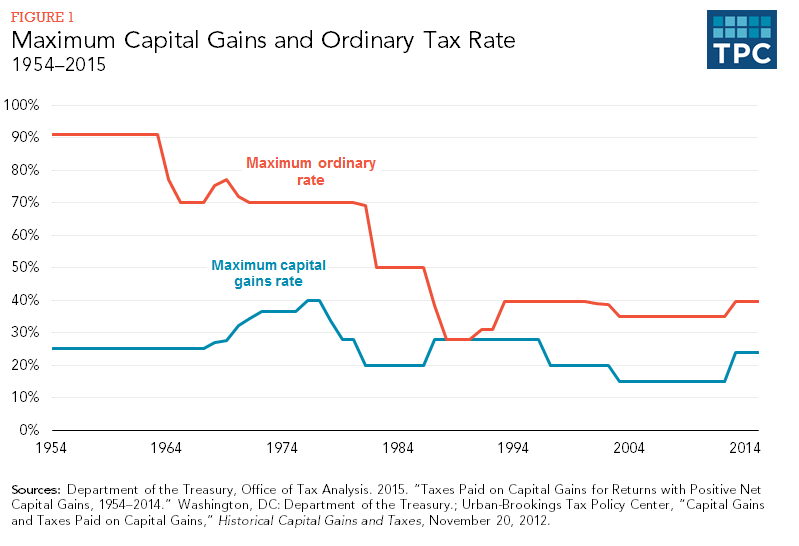

So for 2018 through 2025 the tax rates for higher-income people who recognize long-term capital gains and dividends will actually.

. Web Check out the gallery for 12 important tax and financial planning questions and answers advisors should be aware of regarding such issues according to ALMs Tax Facts. Web If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of 28. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

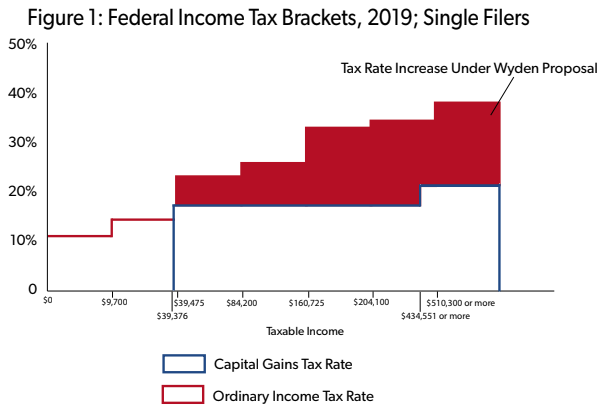

Web This is a good thing because the tax laws provide a preferential tax rate of either 0 15 or 20 on long-term capital gains property depending on your overall income. Restore estate and gift taxes to 2009 levels-015. With average state taxes and a 38 federal.

Assets other than stocks may have different rates for capital gains taxes. Web Understanding Capital Gains and the Biden Tax Plan Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. And the corporate tax rate.

For Health Savings Accounts HSAs the 2022. Web Investments in equity or equity-linked mutual funds for more than one year are considered as long-term and attract a 10 tax on gains of more than 100000 rupees. Web When you include the 38 net investment income tax NIIT that rate jumps to 434.

Web Chancellor Jeremy Hunt has announced the annual exempt amount for capital gains tax is to be cut next year. Web The new plan proposes raising the top capital gains tax rate from 20 to 25 instead of nearly doubling it to 396 as Biden had initially proposed. Web Tax capital gains and dividends at 396 on income above 1 million and repeal step-up in basis-002.

Web In addition to a federal capital gains tax you might have to pay state capital gains taxes. Rates would be even higher in many US. If you include state income taxes the tax rate could rise to as much as 48.

Web The new tax law also retains the 38 NIIT. Web The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net investment income tax. Web This new capital gains tax bracket would apply only to individuals with adjusted gross income AGI in excess of 1 million.

Web The official speaking at an event in New Delhi said India would exceed budget estimates for direct tax collection by 25-30 in FY2023. Web Last week news reports quoted Central Board of Direct Taxes CBDT Chairman Nitin Gupta saying that Budget 2023-24 was expected to announce changes in capital gains. Limit the tax benefit.

Guidance surrounding health accounts for 2022 is not new but it is an area to consider in your overall planning. India is planning changes to its capital gains tax structure in the next budget seeking to bring parity among tax rates and holding periods for investments across. Web President Joe Biden has been expected to introduce a higher capital gains tax rate totaling 434 for the wealthiest taxpayers earning 1 million or more strategists said.

Web A heated debate is happening between stock market players and members of the political community over the financial authoritys recent decision to sharply lower standards for. Individuals with AGI under the 1M threshold will. In 2022 it would kick in for single filers with taxable income over 400000 and for married couples at 450000.

Web The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers. The current amount of 12300 will be reduced to 6000 next year. Tax filing status 0 rate 15 rate 20 rate.

That applies to both long- and short-term capital.

Tax Foundation Under President Biden S Tax Plan New York City Would Face A 58 2 Percent Top Combined Capital Gains Tax Rate Https Buff Ly 3v8exmy Facebook

Biden S Capital Gains Tax Plan Fixes Nothing Bloomberg

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Full Report Tax Policy Center

What You Need To Know About Capital Gains Tax

What S In Biden S Capital Gains Tax Plan Smartasset

Irs How Much Income You Can Have For 0 Capital Gains Taxes In 2023

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

Biden Capital Gains Tax Rate Would Be Highest In Oecd

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Structural Questions Abound With New Mark To Market Tax Proposal Foundation National Taxpayers Union

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

Capital Gains Tax What It Is How It Works And Current Rates

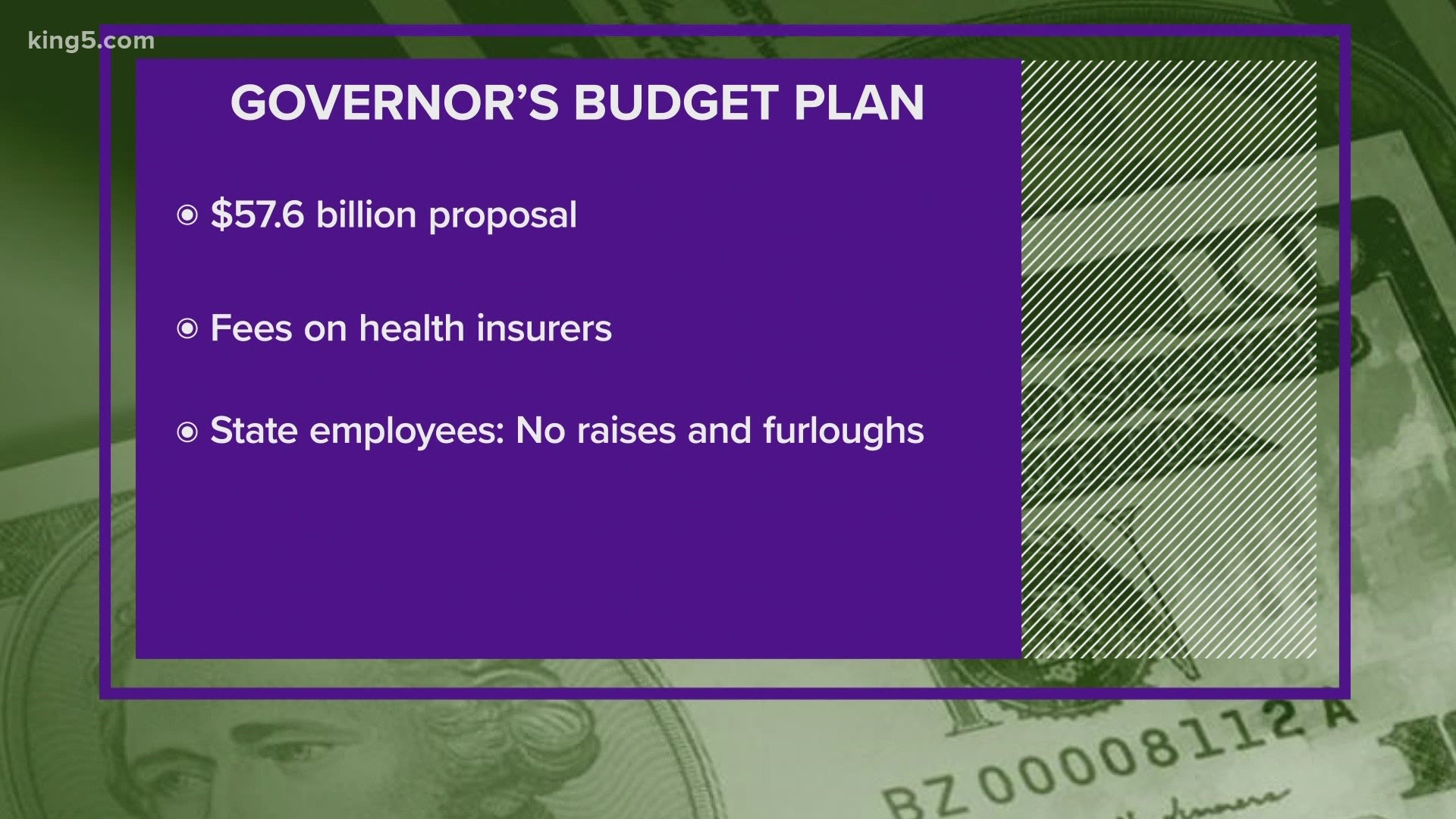

Gov Inslee Proposes Capital Gains Tax Tax On Health Insurers In Washington S 2021 23 Budget King5 Com

Biden S Tax Plan And What It Means For You Wilson Financial Advisors

Capital Gains Tax In The United States Wikiwand

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes